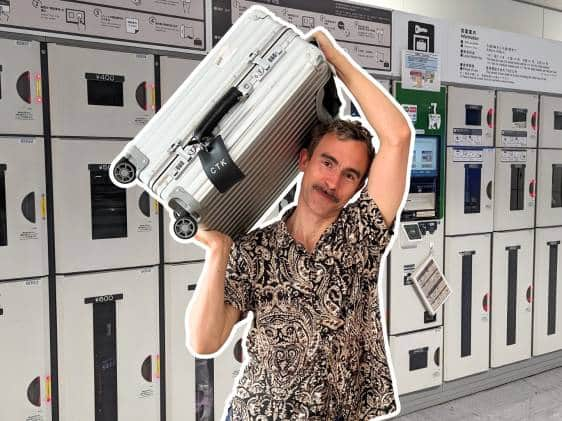

Shinkansen luggage rules — causing confusion for travelers to Japan since 2020. But worry not, the bullet train is still one of the best ways to get around the country, so here’s what you need to know about bringing your bags on the Shinkansen.

Gone are the days of simply hopping on the bullet train worry-free with your suitcase in tow. Now, there are strict Shinkansen baggage rules dictating both luggage size and storage. What does this all mean? We’ve got the how, when, where, and why of the Shinkansen baggage policies and restrictions — so you can get some of that weight off your shoulders.

The basics: Shinkansen luggage rules

Once upon a time, getting on the Shinkansen with baggage was a fairly simple affair — you got on with your suitcase and stowed it wherever there was space. But in May 2020, JR announced a policy requiring travelers with luggage of a certain size to reserve specific seats on certain Shinkansen routes.

So now, on some Shinkansen lines, you’ll need to do extra planning before you bring your luggage on board. There are two things you’ll need to consider — the overall size of your suitcase and where you want to store it. More on each of those below.

Which Shinkansen routes have baggage size rules?

The good news is that only three Shinkansen routes have strict luggage size rules. But the bad news is that these are pretty popular routes — especially the Tōkaidō Shinkansen, which is the one you take to travel between Tokyo and Kyoto or Osaka.

- Tōkaidō Shinkansen (Tokyo to Osaka)

- San’yō Shinkansen (Osaka to Fukuoka)

- Kyūshū Shinkansen (Fukuoka to Kagoshima)

Restrictions on Shinkansen luggage size

If you have luggage with overall dimensions between 161–250 cm, you’ll need to reserve specific seats on the Shinkansen. Luggage of this size falls into a challenging category: it’s too big to safely store on the overhead luggage racks and also (usually) too big to squeeze in front of your knees.

Shinkansen luggage-size allowance

| Size | Reservation required |

|---|---|

| 160 cm and below | No |

| 161–250 cm | Yes |

| 250 cm and above | Not allowed on train |

Luggage under 160 cm linear dimensions — this is surprisingly big — doesn’t need a seat reservation. It can either be placed in front of you (goodbye, legroom) or in the overhead luggage rack, provided it doesn’t jut out in such a way that it could fall or be bumped. And it’s light enough for you to lift it up.

To put things in perspective, most American airlines also prefer your checked luggage to be under 160 cm (total linear dimensions). International flights from other areas tend to stretch the rules to 200 cm or so, though.

Enormous packages or suitcases over 250 cm won’t be allowed on the bullet train at all. However, this is unlikely to be a problem, as even the largest suitcases are typically under 200 cm in overall dimensions. But if you are the exception, take a look at our section on transporting luggage in Japan.

Editor’s note: If your suitcase is under 160 linear centimeters, you are expected to store it (safely) on the overhead rack or keep it with your person. Basically, JR is done with bags rolling through the aisles.

How to calculate Shinkansen baggage size

You will need to add the width, height, and depth of your suitcase together to come up with the overall dimensions. You can do this pretty easily with a tape measure. And there are baggage-sizers at all Tōkaidō Shinkansen stations, so you can always double-check before boarding. Note that the example dimensions are a max 50 cm (W) + 80 cm (H) + 30 cm (D).

Exceptions

Sports equipment (including, unbelievably, skis, surfboards, and bikes — with covers), musical instruments, wheelchairs, and baby strollers do not need reservations, no matter the size. However, it is strongly recommended that you reserve an oversized luggage seat for a more comfortable journey. For Shinkansen lines without luggage space, you may want to book an extra seat if you can afford it — just in case.

How to reserve Shinkansen seats with luggage storage

Only certain types of seats come with extra luggage storage. These are the seats in the back row of the Shinkansen carriage — just note that the specific seat numbers for this row change depending on the type of Shinkansen you’re riding. The extra baggage storage space is directly behind the last row (unfortunately, you cannot recline these seats if you have baggage behind you).

You will need to reserve these seats before getting on the train, but they won’t cost you more than a regular reserved seat. And with a JR Pass, they are complimentary.

Pro tip: If there are no oversized baggage seats available in the regular cars, consider booking some in a Green Car (it’s like Business Class). The Green Car is not always that much more expensive.

How to reserve seats with luggage space on the Shinkansen

You can make seat reservations the same way you normally would — at a ticket office, a ticket vending machine, or online. Tickets are available to book from one month in advance. Note that you cannot use these seats if you bought a ticket for a non-reserved seat.

Sites and apps for booking Shinkansen tickets (with seat selection)

- Smart-Ex website and app

- Japan Rail Pass Reservation (JR Pass holders only)

- JR West Online

- JR Kyushu Online

- Eki-net (Japanese only)

Reserving the Shinkansen luggage storage compartment

As of May 2023, you can also reserve space in the baggage compartment on the Tōkaidō Shinkansen and San’yō Shinkansen.

The dimensions available are 80 x 60 x 50 cm for the upper space and 80 x 60 x 40 cm for the lower space. You can lock your things in place with an IC card — such as Suica or Pasmo. Note that you will also need to reserve certain seats to use the baggage compartment.

Note: Only some cars on the Nozomi, Hikari, and Kodama Shinkansen services have baggage storage compartments.

How to reserve luggage space in the baggage compartment

The space in the luggage compartment is only available if you reserve certain seats in the cars that have them. You can make the reservation at a ticket office, using a vending machine, or online. We recommend talking to staff at a ticket office if you’re not sure which seats to reserve.

Luggage forwarding and storage services

What if all the spaces are booked up or you just have too much luggage for one person to handle? Luckily, there are alternatives to loading everything onto a Shinkansen. One, you could send your luggage separately with a delivery service — we have a comprehensive guide to baggage-forwarding services. Two, there’s also the option of leaving it behind in a safe spot. For that, read our article on luggage storage in Tokyo.

Shinkansen baggage rules FAQs

Can I take large luggage on the Shinkansen?

You can take luggage on all Shinkansen routes. This goes for both reserved and non-reserved seats. However, if you are taking the Tōkaidō, San’yō, or Kyūshū Shinkansen, and the total dimensions of your luggage is 161-250 cm, you will need to reserve a seat with luggage storage. If your suitcase is more than 250 cm, you can’t bring it on the Shinkansen at all.

What size luggage is allowed on trains in Japan?

Baggage with total dimensions of over 250 cm can’t be taken on Shinkansen. For local trains there aren’t baggage size restrictions, but at the same time there aren’t baggage storage spaces either. We recommend using a luggage-forwarding service if you have large suitcases and plan to travel on local trains.

How heavy can my bag be?

You may only take two items of luggage onto any Shinkansen, and they cannot exceed 30 kg in weight each.

Can I reserve the special seats even if I don’t have oversized luggage?

Yes, but it is recommended you be a team player and sit in a normal seat if you don’t have oversized luggage.

What if all the oversized luggage seats are fully booked?

You can see if any luggage space is available in the Green Car, which is a bit more expensive (it’s like Business Class). Otherwise, you’re stuck with your bag in front of you, or you’ll have to book a different train.

What if I forget to book?

You will either be charged a ¥1,000 fee and the guard will put your luggage in a designated space (if available), or you might be asked to take a different train if you haven’t boarded yet.

What if I want to take the Kodama (unreserved) Shinkansen service?

There are limited oversized baggage seats on Kodama trains because they go slower and are predominantly used by commuters. There may only be one car for reserved seating, or even none in some cases, so check when booking.

While we do our best to ensure it’s correct, information is subject to change. Post first published in August, 2022. Last updated: March, 2024 by Maria Danuco.

閱讀繁體中文版本: 日本新幹線最新的行李規定指南